Public bonds are an essential component of the financial landscape, offering individuals and organizations a means to invest and secure their financial future. In this blog post, we’ll provide beginners with an introduction to public bonds, exploring their significance, types, and how they can be an excellent addition to your investment portfolio.

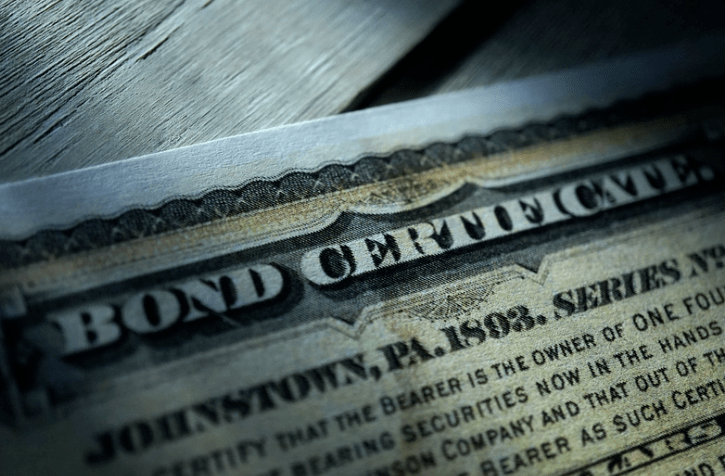

1. Understanding Public Bonds: A public bond is essentially a loan that an investor provides to a government entity or corporation in exchange for periodic interest payments and the return of the bond’s face value upon maturity. These bonds serve as an attractive way for these entities to raise capital and for investors to earn interest.

2. Types of Public Bonds: Public bonds come in various forms, including government bonds, municipal bonds, and corporate bonds. Government bonds are issued by the federal or state government, while municipal bonds are issued by local governments. Corporate bonds, on the other hand, are offered by businesses to raise capital for their operations.

3. Safety and Risk Factors: Public bonds are often considered safer investments, particularly government bonds. However, it’s crucial to recognize that all investments carry some level of risk. The risk associated with bonds depends on factors like the issuer’s creditworthiness and the bond’s duration.

4. Income and Returns: One of the primary benefits of public bonds is the regular interest income they provide. Depending on the type of bond and prevailing interest rates, you can earn a predictable stream of income. Additionally, when the bond reaches maturity, you will receive the face value of the bond.

5. Diversification and Portfolio Building: Public bonds can play a significant role in your investment portfolio. They can add diversity and balance to your investments, especially if you’re looking for assets that are less volatile than stocks. A well-balanced portfolio can help you achieve your long-term financial goals.

Conclusion: Public bonds offer beginners a gateway to the world of fixed-income investments. Understanding their types, safety factors, income potential, and their role in diversifying your portfolio is essential for making informed investment decisions. Whether you’re looking for a steady source of income or a low-risk investment option, public bonds can be a valuable addition to your financial strategy. As you explore the possibilities of public bonds, remember that proper research and a long-term perspective are key to building financial stability and securing your financial future.

Leave a comment